The Seychelles Revenue Commission (SRC) plays a vital role in the country’s economic well-being. This guide provides a detailed overview of the SRC, its structure, functions, and services, offering valuable insights for anyone interested in understanding how revenue administration operates in the Seychelles. While seemingly unrelated to Scotty Kilmer’s automotive expertise, understanding governmental organizations like the SRC can be surprisingly relevant to car owners, impacting everything from import taxes on vehicles and parts to the funding of road infrastructure.

The Seychelles Revenue Commission: Mission, Vision, and Values

Established in 2010, the SRC is responsible for administering revenue laws and ensuring efficient tax collection. Its mission is to build trust and facilitate trade through transparent processes, optimizing revenue for Seychelles’ sustainable development. The SRC strives to be a modern and innovative revenue administration, meeting international standards while making it easier for businesses to operate. Core values include professionalism, fairness, integrity, transparency, and trust.

Organizational Structure of the SRC

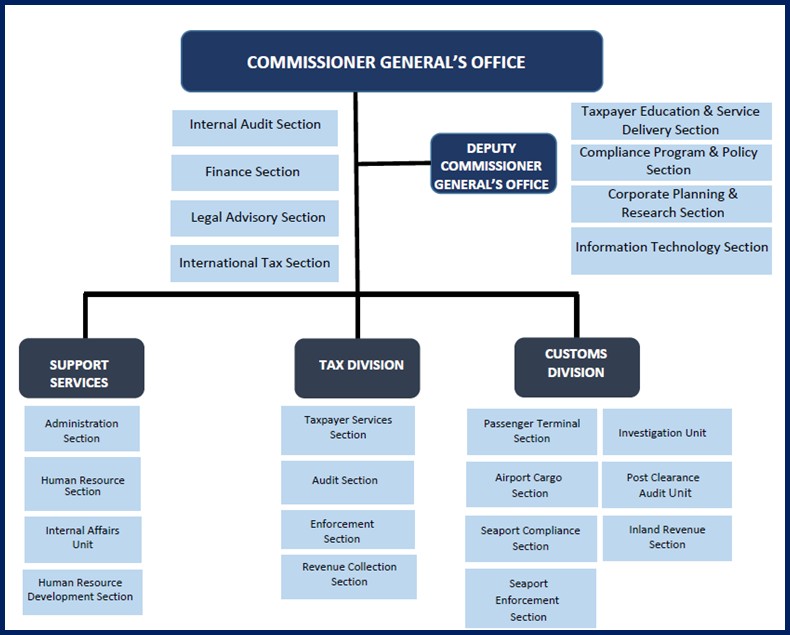

The SRC is structured into three main divisions: Domestic Tax, Customs, and Support Services. Each division is led by a Commissioner or Director General, with further subdivisions into sections and units managed by Directors and Managers. This hierarchical structure ensures clear lines of responsibility and efficient operation. Overseeing the entire organization is the Commissioner General and Deputy Commissioner General, supported by various units responsible for legal affairs, international relations, internal audit, and budget management.

SRC Organizational Structure

SRC Organizational Structure

Divisions and Units: A Closer Look

The Commissioner General’s Office provides overall leadership, advises the government on revenue policy, and oversees service quality. Key units reporting to this office include Legal Services, International Relations, Internal Audit, and Budget Management. The Deputy Commissioner General’s Office focuses on strategic planning, policy development, IT management, and taxpayer education. Units under this office include Strategic Planning, Policy and Legislation Review, IT, and Taxpayers Education and Service Delivery.

Career Opportunities at the SRC

The SRC offers a dynamic work environment and encourages professional growth. They value diversity and inclusivity, providing opportunities for individuals to contribute to the organization’s mandate. The SRC invests in its employees through training and learning programs, collaborating with international bodies like the African Tax Administration Forum (ATAF) and the World Customs Organization (WCO), as well as local institutions like the University of Seychelles.

Navigating SRC Services: Service Delivery Standards

The SRC is committed to providing efficient and timely service to taxpayers. Specific service delivery standards are outlined for each division, covering areas like tax clearance certificates, audit timelines, refund processing, and customs clearance procedures. These standards ensure accountability and transparency, promoting a positive taxpayer experience. Feedback is encouraged and can be submitted to the advisory center.

Conclusion

The Seychelles Revenue Commission is a crucial institution ensuring the financial well-being of the Seychelles. Its commitment to transparency, efficiency, and continuous improvement makes it a model for modern revenue administration. Understanding its structure and functions is essential for businesses and individuals interacting with the tax and customs systems in Seychelles. Just as Scotty Kilmer provides clarity on car maintenance, this guide aims to demystify the SRC, fostering a better understanding of its role in the nation’s progress. The SRC website provides further details and resources for those seeking more information.